37+ pay off mortgage with 401k cares act

If you have a low mortgage balance and a substantial 401 k balance you might be able to pay the mortgage. Web The CARES Act from Congress eliminated the 10 early-withdrawal hit and 20 federal tax withholding on early 401 k withdrawals for those impacted by the crisis.

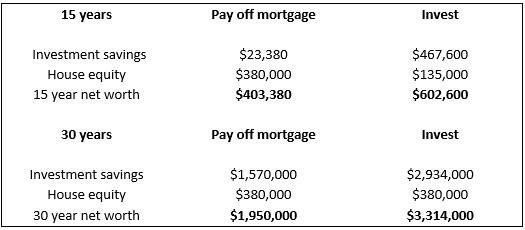

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

Web The CARES Act allows you to withdraw up to 100000 from your retirement account -- penalty-free -- until the end of 2020.

. Web The new CARES Act increases the potential size of loans from 401 k-style plans to a maximum of 100000 from 50000 before. The plan account holder their spouse or dependent has been diagnosed with COVID-19. Web Paying off a mortgage is one reason you might borrow from a 401 k.

An individual can now take a withdrawal of up to 100000 from. Web If you plan to pay off your mortgage draw from the source that has the lowest interest rate first. Borrowers might qualify if they meet one of the following criteria.

Web The new provisions from the CARES Act allow Americans to draw down money from tax-deferred accounts without penalties. Having different buckets of money to pull from is important. For example if your retirement account earns 67 and your savings account only earns 15 you may want to keep your retirement money where it is and use your savings.

So far relatively few Americans have taken advantage of this new. Web The CARES Act has made it easier for workers suffering due to the Covid-19 pandemic to tap their 401 k plans and IRAs. For a conventional 30-year.

Web Normally a withdrawal from a 401 k or IRA before age 59 12 would incur a 10 early withdrawal penalty but the CARES Act waived this penalty for 2020. It also relaxes rules on taking out a loan from a 401k savings plan. Those who have already borrowed against their retirement accounts will receive an extension of time to.

Yes your 2020 taxes will increase. Under normal circumstances those who are younger than 59 ½ must pay income taxes as an early withdrawal penalty of 10 percent on any cash pulled from their 401k or 403b plans. Under normal circumstances those who are younger than 59 ½ must pay income taxes as an early withdrawal penalty of 10 percent on any cash pulled from their 401k or 403b plans.

While you will owe taxes on that sum since the original contributions were pre-tax that amount can be spread over three years. Web If youre younger than 59½ youre ordinarily subject to a 10 percent early withdrawal penalty in addition to income tax if you remove money from an IRA 401k or 403b retirement account. Web A 40000 distribution is more than 20 of your combined retirement assets more than 36 of your individual Thrift Savings Plan balance alone.

He also pointed out that if youre paying say 25 on your mortgage and you pay it off you essentially just earned that rate on the money you used to. Web If you do qualify to take advantage of CARES Act retirement plan benefits paying off your mortgage with those funds would help save you money over time. Income tax is still due on the.

Web Heres a look at more retirement news. Web If you do qualify to take advantage of CARES Act retirement plan benefits paying off your mortgage with those funds would help save you money over time. Web Under the CARES Act only certain individuals are eligible to take advantage of the altered retirement plan rules.

Web Cashing out your 401 k and using the proceeds to pay off your mortgage lets you borrow at a low rate and invest at a high rate and do so at no risk. But this increase isnt automatic employers must adopt these. Web In general section 2202 of the CARES Act provides for expanded distribution options and favorable tax treatment for up to 100000 of coronavirus-related distributions from eligible retirement plans certain employer retirement plans such as section 401 k and 403 b plans and IRAs to qualified individuals as well as special rollover.

Web Another advantage of withdrawing funds from a 401 k to pay down a mortgage balance is a potential reduction in interest payments to a mortgage lender. With retirement planning you either have. Web The CARES act affects retirement accounts such as 401k accounts by lifting penalties for early withdrawal.

Web The CARES Act provides that qualified individuals may treat as coronavirus-related distributions up to 100000 in distributions made from their eligible retirement plans including IRAs between January 1 and December 30 2020. Typically those who havent reached 59½ must pay a 10 percent penalty money withdrawn from their 401 k. Web These penalties apply to 401 k withdrawals rather than 401 k loans.

Employees affected by the coronavirus who have 401k accounts are able to access their retirement accounts for up to 100000.

Can A Foreign Company In U S A Avoid Paying Taxes At All Quora

Can I Use My 401 K To Pay Off My Mortgage

Repaying Your Cares Act Retirement Plan Loan Or Distribution Parkshore Wealth Management

How To Pay Off A 401k Loan Early The Budget Diet

Cares Act Summary R Fatfire

Personal Finance Apex Cpe

The Cares Act Changed All Of The Rules About 401 K Withdrawals Here S Everything You Need To Know Cnet

Should I Pay Off My Mortgage With Money From My 401 K The Washington Post

Seven Days February 8 2017 By Seven Days Issuu

Can I Use My 401 K To Pay Off My Mortgage

Should I Use My 401 K To Pay Off My Mortgage 5 Things To Consider Principal Com

401k Plan Loan And Withdrawal 401khelpcenter Com

Why You Shouldn T Use Your 401 K To Pay Off A Mortgage

Employer Student Loan Repayment Benefit Will You Get Tax Free Money

Leesburg Today June 5 2014 By Insidenova Issuu

How To Pay Off A 401k Loan Early The Budget Diet

Here S Why You Should Repay Your Cares Act 401 K Withdrawal Within The Allowable 3 Year Window